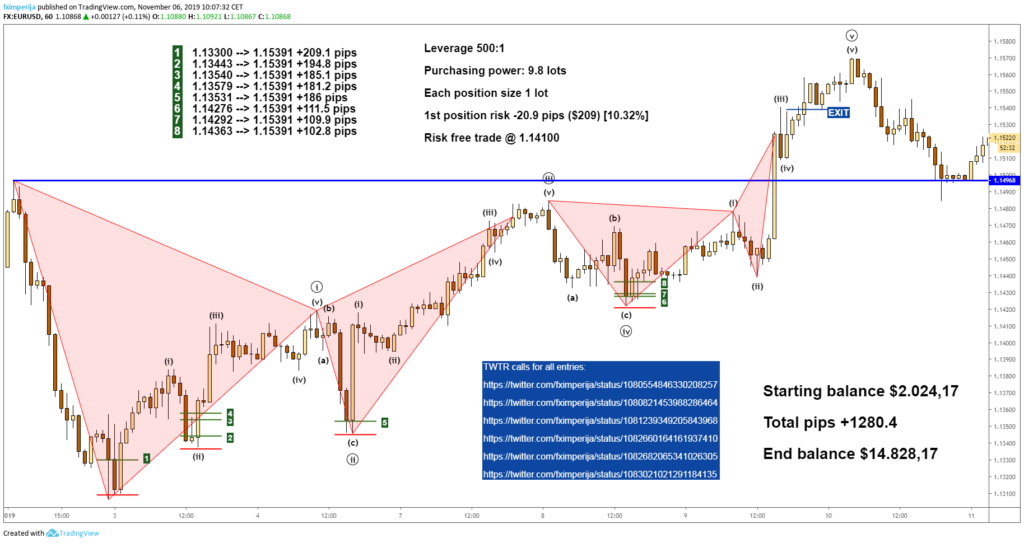

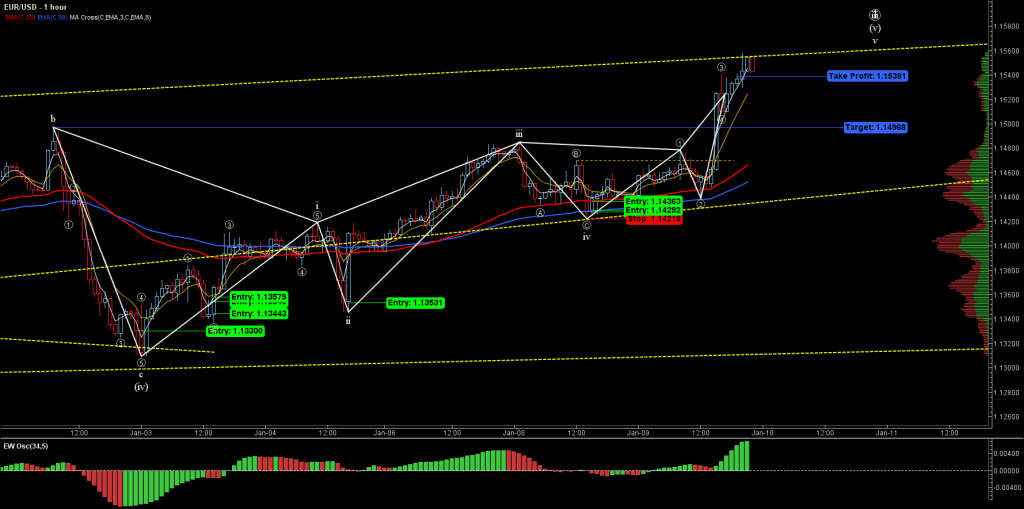

This is a perfect example of The Method in action. ARES is the automated version of The Method performing in the same way but without the need to know The Method to achieve the same results.

Detailed Analysis Of The Trade

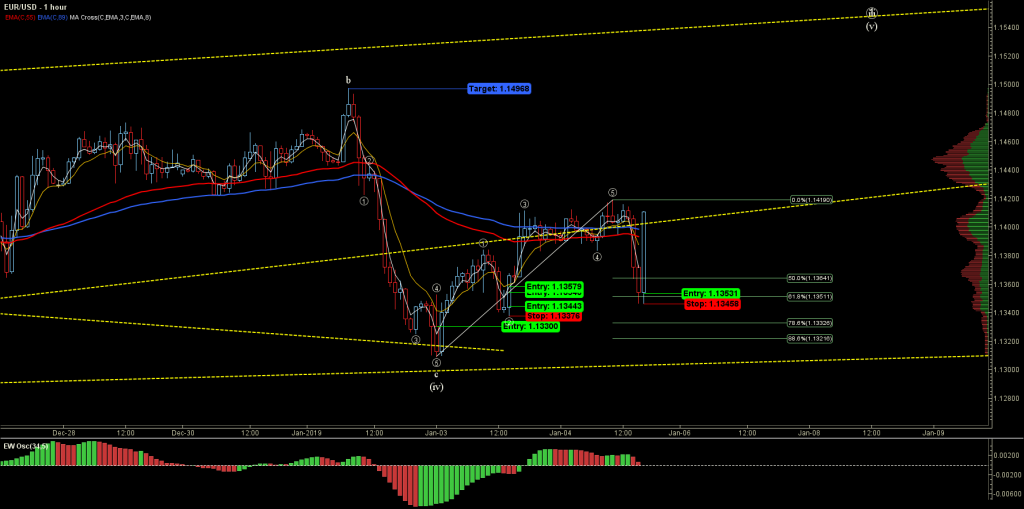

The previous analysis shows that price made the wave(iii) top, performed a flat abc correction into wave(iv), counting 5 waves decline into wave c (wave(iv)). This provided opportunity to get long into wave(v).

According to Elliott Wave Principe, the wave(v) should at least reach the previous wave(iii) top and go beyond. Since price made a flat correction with wave b being higher than wave(iii) this should be target on this trade, at 1.14968.

The entry was very aggressive at 1.13300, with a stop at 1.13090 and target at 1.14968 (the wave b high). This setup provided an excellent R/R (Risk/Reward ratio) of 1:8.

The starting balance was just $2024 and a risk of $210 was roughly 10% for a potential gain of $1670 or 82%.

https://twitter.com/fximperija/status/1080554846330208257

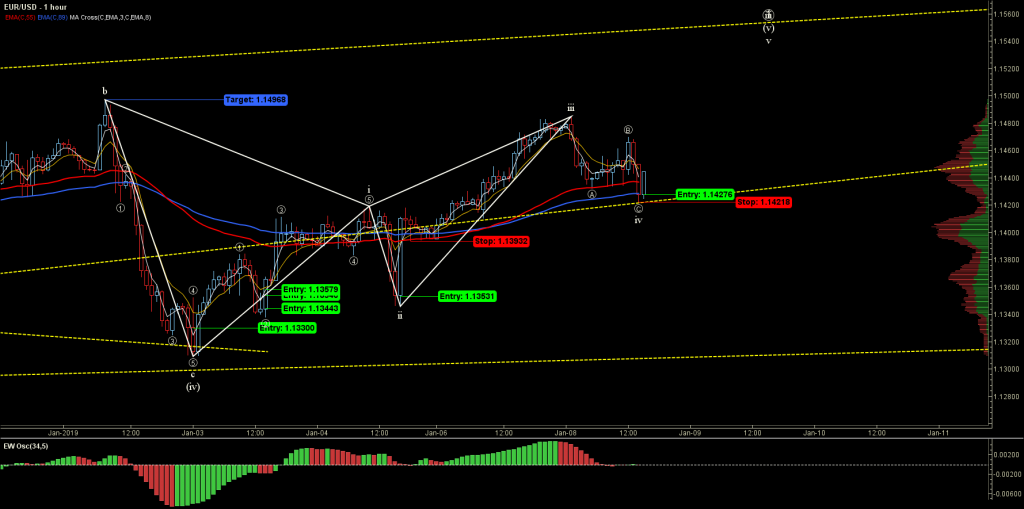

After wave 1 top around 1.13800 and pullback into textbook wave 2 at 61.8 retracement I added one position just above the previous doji close at 1.13376 and 2 more positions at 1.13540 and 1.13579 on the way up. The 2nd position was close the doji high and the 3rd when price broke higher above the doji high. The price action is going for the wave 3 top and I am following with 4 positions now.

Stop has been placed below the low of the bullish candle low on all 3 new positions at 1.13376 risking $420 for a gain of $4350 with a R/R roughly 1:10.

https://twitter.com/fximperija/status/1080821453988286464

Price broke higher, closed above the previous wave 1 and above the EMA55, inside the EMA55/89 river. Closing with a new high was a signal to roll the stop of my 1st position to the stop level of the 3 positions I added, at 1.13376.

This way I protected my 1st position and even locked in $76 of profits lowering my overall risk to $344 for a gain of $6020. At that moment my R/R profile was 1:17.

1:17 is an astonishing R/R!

Price rose higher making the wave(iii) and went sideways in a flat correction marking wave(iv). Soon after, price spiked higher but didn’t close higher above the wave(iii) high making the wave(v). This Elliott Wave structure is known as a diagonal where the wave(i) is the longest wave and wave(v) the shortest. These 5 impulse waves made the minute wave i and price pulled back around 61.8% in an abc correction again making the minute wave ii low.

On the bullish candle after wave ii low a 5th position at 1.13531 has been added with stop just below the candle low and stops from all previous positions rolled to that level.

To summarize the overall risk and potential profit. Only the last 3 positions have risk of $270 while the first 2 are protected with locked profits of $180 which gives a total risk of $90. The total potential profit is $7457.

The R/R rose to insane 1:83.

https://twitter.com/fximperija/status/1081239349205843968

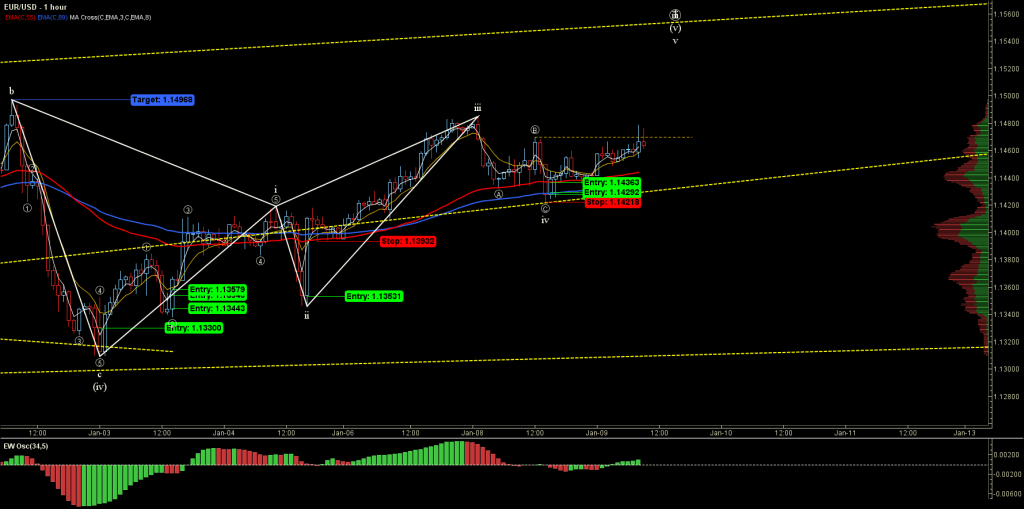

Price rose significantly and went back into previous wave(v) highs marking the wave(i) of minute wave iii. Again, sideways price action slightly lower marking the wave(ii) and soon after there was a breakout above previous wave(v).

The trade progresses with 5 open positions targeting the harmonic completion above 1.14700 level. Before completing the harmonic price made the wave(iii) top and wave(iv) pullback continuing into wave(v) and minute wave iii top. This top has been marked with a double top price action and immediately pulls back around 38.2% into minute wave iv performing abc correction.

Please note how the price respects the EMA55 as support before the price dips to EMA89 ending the abc correction and making the wave iv low.

On the bullish candle rising from the wave iv low 1 more position have been opened, 6th at 1.14276 and stops from all previous 5 positions have been rolled to last consolidation/support level at 1.13932.

Soon after 2 more positions have been added at 1.14292 and 1.14363.

https://twitter.com/fximperija/status/1082660164161937410

https://twitter.com/fximperija/status/1082682065341026305

After rolling the stops the trade has no risk at all because the protective stop locked in more profit than the last 3 positions have risk.

The risk on last 3 positions is $280 while the locked in profit is $2260. If the price for some reason turns sharply and triggers the stops the gained profit would be $1980, meaning 97% gain on balance.

The trade has now 8 positions and almost at margin. Price rises to wave B high unable to break and pulls back finding EMA55 as support. This pull back was the retrace of smaller degree wave 1 into wave 2 and after forming a double bottom rises sharply breaking the resistance.

This price action formed yet another potential harmonic with a target above the initial target of 1.14968 on the way to wave(v) high.

All stops have been rolled to last stop level at 1.14218 locking even more profits, $3710.

Price completed the harmonic and pulled back forming the wave 3 and wave 4.

I closed all 8 positions at 1.15391 banking exceptional profits on this trade.

https://twitter.com/fximperija/status/1083091939854028801

This is the essence of The Method and will be implemented in ARES. It will guide a trader through the trade with risk and trade management just like in this example.